A record number of Summit County property owners challenged the valuation of their homes in 2023, but more than half of them lost their appeal.

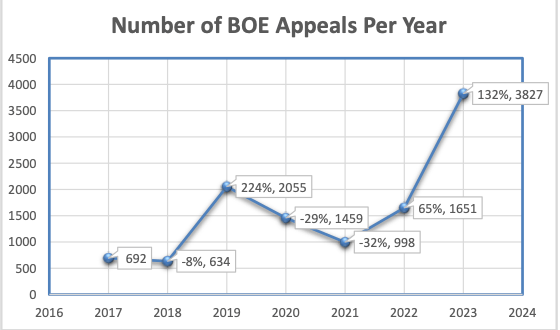

The Board of Equalization processed 3,827 appeals in 2023, a 132% increase from the previous year. Property values in Summit County saw an average increase of more than 50% last year, causing an influx of residents to question their tax bills.

More than 70% of appeals in 2023 were for the home value, while about 24% were for a primary/non-primary designation, and 5% were dismissed.

Homeowners had until Sept. 15, 2023, to appeal their valuation, and the Summit County Auditor’s Office was flooded with more requests than ever before. There were 1,651 appeals filed in 2022 compared to 998 in 2021 and 1,459 in 2020.

Once an appeal is filed, the County Assessor’s Office reviews the information provided and prepares a final notice of recommendation to the Board of Equalization. There were 1,555 appeals, or 42%, that received a market value adjustment. Property owners can then agree to the recommendation or request an independent hearing.

Only about a quarter of the appellants requested a hearing. Officers scheduled 442 hearings. More than 60% sustained the original recommendation and 30% were changed. Almost 10% of hearings were canceled.

Most of the appeals were made to commercial real estate properties, condos and homes in the Snyderville Basin. Primary home values increased by around 29%, second-home values increased by 38%, and commercial properties increased by 67% overall in 2023.

The changes caused the total market value in Summit County to decrease by almost $800,000. The total taxable value in Summit County dropped by 4%, ending up around $48 billion. It’s $2 billion less than expected, but that’s still a 40% increase over 2022.

The Assessor’s Office launched an interactive website last year to increase accessibility to valuation information by sharing public information about Summit County properties. The map is intended to help taxpayers examine the equity of tax assessments.

The Summit County Council has already approved the hearing officer decisions in previous meetings. A representative from the Auditor’s Office will provide a summary to the County Council at 5 p.m. on Wednesday.

Concerns about rising property taxes have been growing in Summit and Wasatch counties for the past few years. Summit County officials hired additional staff to help with property valuations and appeals after Summit County Assessor Stephanie Poll raised concerns her office was falling behind.

Property valuations for 2024 have been mailed to homeowners, and tax bills will start to arrive in October. This year’s tax values are based on 2023 sales. Sales volumes may have decreased countywide, but home prices have not.

Visit summitcounty.org/220/Assessor for more information about property taxes.